Investing in Portugal: the ultimate guide for foreign residents

Investing in Portugal

Thinking about investing in Portugal? Discover why foreign residents are finding this country a safe and inspiring place to build their future.

Portugal has quietly become one of Europe’s most compelling destinations. Beyond the lifestyle allure, Portugal offers a strong case for investment for those seeking real estate or business opportunities with strong potential. Foreign residents are discovering a country that welcomes them with open arms, clear rules, and promising returns. This guide is here to help you explore opportunities so you can decide if Portugal is the right place for your next investment.

Why Portugal stands out for real estate investment

From favourable tax conditions to competitive pricing, Portugal has positioned itself as one of Europe’s most attractive real estate destinations.

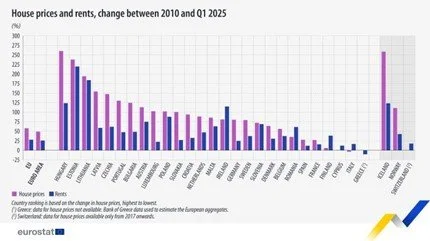

1. Competitive prices compared to Europe

Despite strong growth in Lisbon and Porto, Portuguese property prices have not yet reached the levels of Europe’s most expensive markets.

[Source: Eurostat]

For foreign residents, this means that prime locations (such as historic city centres, coastal retreats, or vineyard estates) are still more accessible than in other luxury markets.

2. Strong appreciation over the past decade

Portugal’s property market has experienced consistent appreciation in recent years, driven by international demand, urban regeneration, and the country’s increasing visibility as a luxury destination. For investors, this translates into capital gains potential that continues to outperform expectations.

3. Attractive tax incentives

Portugal has introduced measures designed to welcome foreign residents and investors. Programs such as the Non-Habitual Resident (NHR) regime have made the country particularly appealing, offering reduced tax rates and, in some cases, exemptions on foreign-sourced income. These incentives, combined with a stable legal framework, create an environment of confidence for those looking to invest.

4. Lifestyle meets investment value

Beyond the numbers, real estate in Portugal offers something rare: properties that deliver financial return while enhancing quality of life. Whether it’s a villa in Porto, pied-à-terre in Lisbon, a nice apartment in Algarve, or a countryside retreat, the lifestyle factor adds depth and long-term value to any investment.

Step-by-step guide to invest in real estate in Portugal

Buying a property abroad can feel daunting, but in Portugal the process is far more transparent and straightforward than many expect. To help you move with confidence, here’s a clear roadmap of the most important steps every foreign resident should keep in mind.

1. Define your investment goals

Before diving into property listings, it’s worth pausing to ask yourself what role this purchase should play in your life and portfolio. For some, the goal is lifestyle-driven. Others are motivated by steady rental income, often targeting properties in areas with strong tourism demand or international student populations.

Then there are those who see Portuguese real estate as a long-term wealth-building strategy – buying in up-and-coming regions where prices are still below the European average but showing steady appreciation. Your goals will shape everything else, like location, budget or tax planning.

2. Choose the right location

Location is the heartbeat of any property investment. The country may be small on the map, but each region has a distinct rhythm, lifestyle, and investment potential.

Porto: Known for its charm and character, Porto blends history with a growing international presence. Property here is often more affordable than in Lisbon, yet demand is steadily rising. For investors, it’s a sweet spot: strong appreciation potential without the capital’s price tag.

Lisbon: Portugal’s capital is vibrant, cosmopolitan, and constantly evolving. Lisbon offers strong rental yields in iconic places like historic Alfama or the polished avenues of Chiado, both for long-term residents and the short-term rental market. Investors here are betting on property value and also on a city that continues to reinvent itself as a global hub for culture and business.

Algarve: A natural choice for those seeking lifestyle and leisure. Its golden beaches, golf courses, and international schools make it especially appealing for families and retirees. Demand from both tourists and expats ensures that rental properties, especially villas, perform consistently well.

Emerging Hotspots: Beyond the “big three,” areas like the Douro Valley, Comporta, and Alentejo are attracting attention for their exclusivity and authenticity. These regions appeal to investors looking for unique properties, often with larger plots of land, where luxury feels more private and understated.

Investing in Portugal

3. Work with a trusted local partner

The Portuguese property market is rich with opportunity, but, like any market, it has its nuances. The process involves legal steps, tax considerations, and often fast-moving negotiations. For foreign investors, having a trusted local partner could be essential.

A knowledgeable advisor helps in several ways:

Access to the right properties: Many of Portugal’s most desirable homes, especially in the luxury segment, never make it to public listings. Local experts often open doors to opportunities that would otherwise remain hidden.

Steering the legal framework: The process of promissory contracts or notarial deeds can feel complex. A reliable partner ensures everything is transparent, properly documented, and aligned with your best interests.

Connecting with specialists: Beyond the property itself, you’ll likely need lawyers, notaries, tax advisors, and property managers. At Epoca Properties we cater to prospective buyers looking for unique real estate in prime locations in Portugal.

4. Understand the legal process

Buying property in Portugal follows a well-structured and transparent legal process, but for foreign residents, the terminology and steps can feel unfamiliar at first.

The journey typically unfolds in two key stages:

Promissory Contract (Contrato de Promessa de Compra e Venda): Once you’ve found the right property and agreed on terms, buyer and seller sign a promissory contract. This document formalises the deal and usually involves a deposit of around 10%. It secures the property and lays out all the conditions of the sale. If either party pulls out without valid reason, there are clear legal consequences (for example, the seller may have to return double the deposit).

Final Deed (Escritura): The final deed is signed in front of a notary, where the balance of the purchase price is paid, and ownership is officially transferred. From this moment, the property is legally yours. The deed is then registered with the Land Registry (Conservatória do Registo Predial), which ensures your rights are formally recognised.

Along the way, there are other steps that matter, such as obtaining a Portuguese tax number (NIF), carrying out due diligence on the property’s legal status, and verifying that no debts or restrictions are attached to it.

While the system is designed to be clear and fair, having legal guidance adds an extra layer of reassurance. They will make sure every document is in order and that your interests are fully protected.

5. Factor in taxes and costs

When investing in real estate, the purchase price is only part of the story. Portugal offers a transparent and relatively competitive tax system, but it’s important to plan ahead. Here are the main costs every foreign buyer should be aware of:

IMT (Property Transfer Tax): This is the largest one-off tax when buying a property. It’s calculated on a progressive scale depending on the property’s value and whether it’s a primary residence, secondary residence, or investment. Rates range from 0% (on very low-value homes) up to 7.5% for higher-value properties.

Stamp Duty (Imposto de Selo): A flat 0.8% of the declared purchase price, payable at the time of signing the final deed.

Notary, Registration, and Legal Fees: Compared to other European countries, these are relatively modest. They usually represent a small fraction of the total purchase and cover the legal formalities to ensure your ownership is fully registered and protected.

Annual IMI (Municipal Property Tax): Once you own the property, you’ll pay IMI every year. Rates are set by each municipality and usually range from 0.3% to 0.45% of the property’s taxable value (Valor Patrimonial Tributário), which is often lower than the market value.

Additional Costs for Luxury Properties: For properties above €1 million, an additional tax called AIMI (Adicional ao IMI) may apply. This is a progressive annual surcharge, relevant mainly for very high-end or multiple-property owners.

6. Consider financing options

For many foreign residents, one of the pleasant surprises about investing in Portugal is how accessible local financing can be. Portuguese banks are accustomed to working with international clients and offer mortgage solutions that make entering the market smoother than expected.

Here’s what to keep in mind:

Loan-to-value ratios: Non-residents can typically access financing for up to 60-70% of the property’s value, while residents may qualify for slightly higher ratios. This means you’ll usually need to cover around 30-40% with your own funds, plus the associated taxes and fees.

Interest rates: Portugal has benefited from historically low interest rates, and while these fluctuate, they often remain competitive compared to other European markets. Buyers can usually choose between fixed, variable, or mixed-rate mortgages depending on their risk profile and investment horizon.

Documentation required: Banks will request proof of income, tax returns, bank statements, and identification. For foreign investors, documents may need to be translated and certified. A local partner or lawyer can help streamline this step to avoid delays.

Approval timeline: Mortgage approval usually takes a few weeks, though this can vary. Having pre-approval before making an offer strengthens your negotiating position, especially in competitive markets like Lisbon and Porto.

Currency considerations: If your income is in a currency other than euros, it’s worth factoring in exchange rate fluctuations. Some investors choose to hedge this risk with financial instruments, while others view it as part of their overall investment strategy.

7. Plan for ongoing management

Owning a property abroad is exciting, but it also comes with responsibilities, like everyday maintenance or tenant relations. Good management is what keeps your investment performing well over time and protects its value.

Property maintenance: Regular upkeep ensures your home remains in top condition. Think cleaning, gardening, security systems, or even pool maintenance. For owners who don’t live in Portugal year-round, outsourcing this to a professional service is often the easiest route to peace of mind.

Rental management: If you plan to rent your property, management becomes even more important. This involves finding tenants, handling contracts, collecting rent, and ensuring compliance with local rental laws. In popular tourist areas, there are also licensing requirements for short-term rentals (Alojamento Local), which a local manager can help you cope.

Technology and transparency: Many modern management firms now offer online dashboards where owners can monitor bookings, expenses, and returns in real time. For international investors, this kind of transparency makes managing a property from abroad far less stressful.

8. Align your investment with tax residency strategy

Investing in Portuguese real estate isn’t just about the property itself - it’s also an opportunity to optimise your broader financial and tax planning. For foreign residents, aligning your purchase with Portugal’s fiscal framework can enhance returns and reduce unnecessary costs.

Non-Habitual Resident (NHR) Regime: One of the country’s most appealing programs, the NHR regime, offers a tax rates of 20% on certain foreign-sourced income for up to 10 years. This can include pensions, dividends, royalties, and capital gains in specific cases. Combining property investment with NHR status can make Portugal a highly efficient tax environment.

Long-term residency considerations: If you plan to spend more time in Portugal, it’s important to understand how becoming a tax resident affects your obligations. Annual reporting, social security contributions, and potential double-tax treaties with your home country are all factors to consider. Early consultation with a tax specialist ensures your property investment complements rather than complicates your residency plans.

Wealth planning integration: Your Portuguese property can be part of a broader wealth strategy. For example, holding it in a legal entity may simplify succession planning, or structuring ownership with family members can optimise tax efficiency and flexibility. These decisions are highly individual, but planning ahead prevents costly adjustments later.

Start investing in Portugal with EPOCA Properties by your side

At EPOCA Properties, we understand that buying abroad can feel complex, especially in a market as dynamic and diverse as Portugal’s. That’s why our team combines deep local knowledge with a global perspective, guiding you through every step.

Explore our carefully curated portfolio of luxury properties and discover options that align with your vision. You can find vibrant city residences, serene coastal retreats, or unique countryside estates. Get in touch.

FAQs about real estate investment in Portugal

Here are answers to some of the questions investors often have when considering Portugal.

1. Can foreigners open a bank account in Portugal to manage property expenses?

Yes. Most major Portuguese banks welcome non-residents, though requirements vary slightly by institution. Typically, you’ll need a passport, proof of address, and a Portuguese tax number (NIF). Having a local account simplifies everything (like paying property taxes, utility bills or receiving rental income) and is highly recommended before completing a purchase.

2. What should I know about property insurance in Portugal?

Insurance is mandatory for mortgages. Policies usually cover fire, flood, and structural damage, with optional coverage for theft or liability. For luxury properties, specialised insurance can protect art, high-end finishes, or additional amenities like pools.

3. Are there restrictions on renting out my property?

Yes, but they are generally straightforward. Long-term rentals are open to most property owners, but short-term rentals (Alojamento Local) require a municipal license. Regulations vary by city, and some popular areas may have caps on new licenses. Partnering with a local property manager ensures compliance and maximises rental potential.

4. Is buying property in Portugal possible for non-EU citizens?

Absolutely. Foreign investors enjoy the same rights as locals regarding property ownership, financing options, and residency benefits (including eligibility for the NHR regime).

5. Can I obtain Portuguese citizenship by investment?

Yes, Portugal offers a pathway to citizenship through its Golden Visa program, which allows non-EU investors to gain residency (and eventually citizenship) by meeting certain property investment criteria. While the initial step is residency, after five years of legal residence, eligible investors can apply for Portuguese citizenship.

6. How can I ensure my property investment aligns with sustainable practices?

Energy efficiency is increasingly valued in Portugal, both for legal compliance and rental appeal. Properties with good insulation, solar panels, or energy-efficient systems often achieve higher rental yields and resale value. Consulting with specialists when selecting a property allows you to consider sustainability not just ethically, but also financially.